BTC Price Prediction: 2025-2040 Forecast Analysis

#BTC

- Technical indicators show Bitcoin testing critical support at $109,715 with MACD suggesting underlying bullish momentum remains intact

- Institutional accumulation continues despite market fear, with major corporations expanding Bitcoin treasury reserves significantly

- Long-term price targets remain elevated with VanEck's $180,000 near-term prediction supported by institutional adoption and global monetary expansion

BTC Price Prediction

Technical Analysis: Bitcoin Faces Critical Support Test

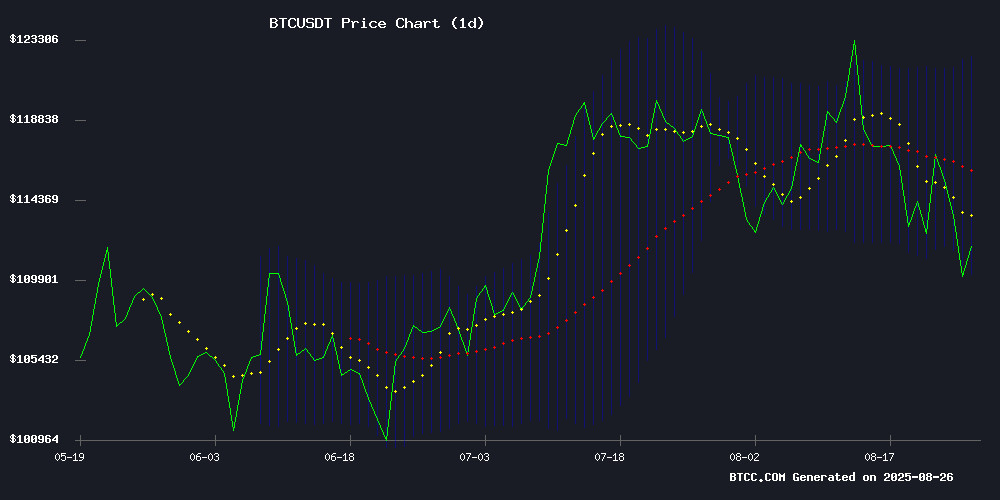

According to BTCC financial analyst Robert, Bitcoin's current price of $109,588 sits below the 20-day moving average of $116,194, indicating short-term bearish pressure. The MACD reading of 2,198.27 versus the signal line at 496.45 shows bullish momentum remains intact despite recent selling. Bitcoin is currently trading near the lower Bollinger Band at $109,715, which serves as immediate support. A break below this level could trigger further declines toward $105,000.

Robert notes: 'The technical setup suggests consolidation between $109,715 and $122,673. Holding above the lower band is crucial for maintaining bullish structure.'

Market Sentiment: Institutional Accumulation Amid Correction

BTCC financial analyst Robert observes mixed market sentiment as institutional players continue accumulating bitcoin despite fear-driven selloffs. News of Metaplanet expanding holdings to 19,000 BTC and Strategy Inc.'s $357 million purchase contrasts with whale liquidations and Wall Street suppression tactics.

Robert comments: 'Institutional accumulation during corrections typically signals long-term confidence. The $2.7 billion whale liquidation creates short-term pressure, but corporate treasury strategies and Japan's crypto support provide fundamental strength. Market fear is being countered by strategic buying at these levels.'

Factors Influencing BTC's Price

Bitcoin Faces Fear-Driven Selloff as Key Metrics Signal Weakness

Bitcoin's rally falters as the cryptocurrency retreats 3% to $111,398, testing critical support at $105K. The pullback from its $124K all-time high reveals diverging behaviors among holders—small wallets accumulate while large investors distribute.

On-chain metrics paint a concerning picture. The NVT Ratio's 11% drop to 33.8 signals weakening transactional strength relative to valuation. Network activity deteriorates with Transaction Counts falling to 97K and Network Growth sliding to 72K addresses, suggesting eroding organic demand.

Market sentiment hangs in the balance. A successful defense of $105K could restore confidence, but failure may trigger cascading liquidations. The standoff between accumulating retail and distributing whales mirrors Bitcoin's fundamental tension—speculative froth versus long-term conviction.

Wall Street Strategies Suppress Bitcoin's Bull Run Despite Institutional Buys

Bitcoin's price stagnation despite growing institutional adoption has puzzled market participants. Preston Pysh, appearing on Coin Stories, attributes this phenomenon to sophisticated Wall Street trading strategies rather than weakening conviction among long-term holders.

Delta-neutral volatility harvesting tactics employed by major financial institutions are creating headwinds against Bitcoin's upward momentum. These mechanisms extract basis and funding premia while deliberately suppressing price volatility, counteracting bullish catalysts like corporate treasury purchases.

The disconnect between fundamental adoption signals and price action highlights evolving market microstructure complexities. As traditional finance entities increase Bitcoin exposure, their trading operations simultaneously introduce new dynamics that challenge retail investor expectations of parabolic moves.

Bitcoin Holds $110K Amid Japan's Crypto Support and CBDC Concerns

Bitcoin maintains its position above $110,000 despite a 2.5% dip, with daily trading volume hitting $84 billion. The cryptocurrency's market capitalization stands firm at $2.19 trillion, retaining dominance after recent corrections. Market dynamics reflect a confluence of global policy signals, institutional interest, and technical indicators pointing toward Bitcoin's next growth phase.

Japan's Finance Minister Katsunobu Katō has publicly endorsed cryptocurrencies as portfolio diversifiers, citing their potential for risk hedging. This stance emerges as Japan contends with a 200% debt-to-GDP ratio and yen depreciation, making digital assets increasingly attractive to domestic investors seeking alternatives to low-yield savings accounts. The minister's comments signal regulatory openness that could accelerate bitcoin adoption in Japan.

Global CBDC developments are fueling Bitcoin's appeal as a decentralized alternative. Recent warnings from a U.K. think tank about programmable central bank digital currencies' potential for government overreach—drawing comparisons to Orwellian surveillance—have strengthened the case for censorship-resistant assets like Bitcoin.

Bitcoin Correction Risks Deepen With $105,000 As Critical Support

Bitcoin's struggle to establish a new all-time high has culminated in a weekly low of $110,820 on Binance, signaling a pronounced pullback phase. The $105,000 level now stands as a critical support threshold, with market participants scrutinizing whale behavior for directional cues.

CryptoQuant data reveals a distribution phase among large holders, contrasting with accumulation patterns in retail-tier wallets. Wallets holding 0–0.1 BTC resumed buying during the dip, while 0.1–1 BTC cohorts accumulated even at peak prices—a divergence suggesting persistent retail confidence amid institutional profit-taking.

ChatGPT’s Bitcoin Analysis Flags $112K Support Amid $2.7B Whale Liquidation

Bitcoin is testing key support at $112,000 following a massive whale selloff involving BTC across major exchanges, triggering liquidation cascades. MicroStrategy counters with a $357 million accumulation, bringing its holdings to 214,246 BTC.

Technical indicators reveal a volatile trading range, with Bitcoin’s price reflecting a decline from its opening level. The RSI approaches oversold territory, suggesting potential bounce conditions. Moving averages show bearish positioning, with BTC trading below key EMAs, while MACD signals continued momentum deterioration.

Volume analysis indicates steady institutional participation despite the selloff. The market now watches for trend reversal signals as whale distribution clashes with institutional counter-accumulation.

VanEck Reaffirms $180K Bitcoin Target Amid Institutional Accumulation

Bitcoin's volatility in August has done little to shake institutional confidence, with VanEck maintaining its $180,000 year-end price target despite a pullback from recent highs. The cryptocurrency briefly dipped to $112,000 before rebounding to $124,000—a new all-time high—demonstrating characteristic resilience.

Institutional players are doubling down: exchange-traded products absorbed 54,000 BTC in July while corporate treasuries added 72,000 BTC. US-listed miners now command 31% of the global hashrate, signaling deepening infrastructure commitment even as mining equities faced headwinds.

Derivatives markets echo the bullish sentiment. CME basis funding rates hit 10%—their highest since February 2025—while options traders continue favoring calls over puts. 'This isn't a breakdown but a repositioning,' one trader noted as BTC stabilized NEAR $115,000, 8% below its peak.

Strategy Inc. Expands Bitcoin Treasury to 632K BTC with $357M Purchase

Strategy Inc. bolstered its Bitcoin holdings by acquiring 3,081 BTC last week at an average price of $115,829 per coin, totaling $356.9 million. The MOVE elevates its corporate treasury to 632,457 BTC, with an aggregate cost basis of $46.50 billion—approximately $73,527 per BTC. The purchases were disclosed in an SEC Form 8-K and updates to the company's dashboard.

The buy coincided with a brief pullback in Bitcoin's price following a summer rally. Historical data from CoinMarketCap shows Bitcoin trading around $112,000 during the purchase period, slightly below Strategy's average acquisition price. The company emphasized its year-to-date BTC Yield of 25.4% for 2025, a key performance indicator tracking Bitcoin returns relative to diluted shares outstanding.

Market reaction to the news was muted, with Bitcoin experiencing modest declines on the days of the purchase. Observers noted Strategy's continued use of at-the-market offerings to fund its Bitcoin acquisitions, as detailed in the 8-K filing.

Metaplanet Expands Bitcoin Holdings to Nearly 19,000 BTC Amid Strategic Reserve Push

Tokyo-listed Metaplanet has aggressively increased its Bitcoin reserves, now holding 18,991 BTC valued at over $2.14 billion. The latest purchase of 103 BTC, worth approximately $11.8 million, underscores the firm's commitment to integrating cryptocurrency into its corporate strategy.

The company's Bitcoin Treasury Operations, formalized in 2023, channels capital from share issuances and bond offerings directly into BTC acquisitions. Since April 2024, Metaplanet has risen to become the seventh-largest public corporate holder of Bitcoin globally, according to Bitcointreasuries data.

President Simon Gerovich's strategy positions Bitcoin as a Core reserve asset, reflecting growing institutional adoption. The firm's inclusion in the FTSE Japan Index further legitimizes its crypto-centric approach in traditional finance circles.

Corporate Treasuries Accumulate Bitcoin Amid Market Correction

Institutional investors are quietly increasing their Bitcoin holdings despite recent market volatility. Data reveals corporations acquired over 7,700 BTC last week, with four new treasury vehicles holding 41+ BTC collectively. Japanese firms ANAP Holdings and an unnamed counterpart added 6.26 BTC and 200 BTC respectively, while Philippine lawmakers proposed a 10,000 BTC strategic reserve.

The market retreat followed a brief rally post-Powell's Jackson Hole speech, with BTC sliding from $117k to $112k. Bitcoin dominance remains steady at 57.6% as total crypto market cap dipped 2.4% to $3.89 trillion. Trading volume surged 81% to $243 billion, suggesting continued institutional activity beneath retail sell pressure.

Treasury adoption continues globally with 48 corporate disclosures analyzed between August 18-24. Sixteen firms announced plans to establish BTC reserves, while five existing holders signaled additional purchases. US-listed DDC Enterprise notably acquired 100 BTC during the pullback.

Bitcoin Reaches 1.7% of Global Money Supply as Fed Rate Cut Fuels Crypto Rally

Bitcoin now represents 1.7% of the global money supply, crossing a significant milestone as institutional and retail investors flock to crypto assets amid shifting monetary policy. The Federal Reserve's dovish pivot has accelerated capital rotation into alternative stores of value, with Bitcoin's market capitalization swelling against the $138 trillion fiat and hard money ecosystem.

Market euphoria shows signs of overheating according to Santiment data, with Federal Reserve-related social media chatter hitting 11-month highs. The analytics platform warns that excessive Optimism often precedes corrections, even as price action remains firmly bullish following Jerome Powell's Jackson Hole remarks.

River's research highlights Bitcoin's growing dominance in global liquidity pools, while technical indicators suggest the rally may face near-term volatility. The cryptocurrency briefly surpassed $116,000 in speculative trading before consolidating, demonstrating both the momentum and fragility of current market conditions.

MicroStrategy's Latest Bitcoin Purchase Sparks Market Debate

MicroStrategy's aggressive Bitcoin accumulation strategy continues to reverberate through crypto markets. The enterprise software firm's latest BTC purchase has reignited discussions about institutional influence on price action, coming at a critical juncture for Bitcoin's market structure.

Michael Saylor's unwavering commitment to corporate Bitcoin adoption now represents 1% of the total supply. Such concentrated buying pressure creates both stability and volatility - stabilizing through reduced liquid supply while potentially exacerbating corrections when whales rebalance.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market dynamics, BTCC financial analyst Robert provides these long-term projections:

| Year | Conservative Forecast | Moderate Forecast | Bullish Forecast | Key Drivers |

|---|---|---|---|---|

| 2025 | $135,000 | $160,000 | $180,000 | ETF inflows, halving effects |

| 2030 | $300,000 | $450,000 | $600,000 | Institutional adoption, regulatory clarity |

| 2035 | $800,000 | $1,200,000 | $1,800,000 | Global reserve asset status |

| 2040 | $1,500,000 | $2,500,000 | $4,000,000 | Mass adoption, scarcity premium |

Robert emphasizes: 'These projections assume continued institutional adoption and macroeconomic conditions favoring hard assets. Short-term corrections like the current 20% pullback from highs are normal in long-term bull markets.'